By accessing or using the BluSignals website, the BluSignalsservice, or any applications (including mobile applications) made available by BluSignals(together, the “Service”), however accessed, you agree to be boundby these terms of service (“Terms of Service”). The Service is owned or controlled by BluSignal Systems, LLC (“BluSignals “). These Terms of Service affect your legal rights and obligations. If you do not agree to be bound by all of these Terms of Service, do not access or use the Service.

There may be times when we offer a special feature that has its own terms and conditions that apply in addition to these Terms of Service. In those cases, the terms specific to the special feature control to the extent there is a conflict with these Terms of Service.

ARBITRATION NOTICE: EXCEPT IF YOU OPT-OUT AND EXCEPT FOR CERTAIN TYPES OF DISPUTESDESCRIBED IN THE ARBITRATION SECTION BELOW, YOU AGREE THAT DISPUTES BETWEEN YOU AND BLUSIGNALS WILL BE RESOLVED BY BINDING, INDIVIDUAL ARBITRATION AND YOU WAIVE YOUR RIGHT TO PARTICIPATE IN A CLASS ACTION LAWSUIT OR CLASS-WIDE ARBITRATION.

Basic Terms

- You must be an individual, not an entity or organization of any kind, and at least 18 years old to use the Service.

- You are responsible for any activity that occurs through your account and you agree you will not sell, transfer, license or assign your account, followers, username, or any account rights. You agree that you will not create an account for anyone other than yourself. You also represent that all information you provide or provided to BluSignals upon registration and at all other times will be true, accurate, current and complete and you agree to update your information as necessary to maintain its truth and accuracy.

- You agree that you will not solicit, collect or use the login credentials of other BluSignals users.

- You are responsible for keeping your password secret and secure.

- You must not post or use private or confidential information to gain access to the Service, including, without limitation, your or any other person’s credit card information, social security or alternate national identity numbers, non-public phone numbers or non-public email addresses.

- You may not use the Service for any illegal or unauthorized purpose. You agree to comply with all laws, rules and regulations (for example, federal, state, local and provincial) applicable to your use of the Service, including but not limited to, copyright laws.

- You are solely responsible for your conduct and any data, text, files, information, usernames, images, graphics, photos, profiles, audio and video clips, sounds, musical works, works of authorship, applications, links and other content or materials (collectively, “Content”) that you submit, post or display on or via the Service.

- You must not change, modify, adapt or alter the Service or change, modify or alter another website so as to falsely imply that it is associated with the Service or BluSignals.

- You must not interfere or disrupt the Service or servers or networks connected to the Service, including by transmitting any worms, viruses, spyware, malware or any other code of a destructive or disruptive nature. You may not inject content or code or otherwise alter or interfere with the way any BluSignals page is rendered or displayed in a user’s browser or device.

- You must not create accounts with the Service through unauthorized means, including but not limited to, by using an automated device, script, bot, spider, crawler or scraper.

- You must not attempt to restrict another user from using or enjoying the Service and you must not encourage or facilitate violations of these Terms of Service or any other BluSignals terms.

- Violation of these Terms of Service may, in BluSignals’sole discretion, result in termination of your BluSignals account. You understand and agree that BluSignals cannot and will not be responsible for the Content posted on the Service and you use the Service at your own risk. If you violate the letter or spirit of these Terms of Service, or otherwise create risk or possible legal exposure for BluSignals, we can stop providing all or part of the Service to you.

General Conditions

- We reserve the right to modify or terminate the Service or your access to the Service for any reason, without notice, at any time, and without liability to you.

- Upon termination, all licenses and other rights granted to you in these Terms of Service will immediately cease.

- We reserve the right, in our sole discretion, to change these Terms of Service (“Updated Terms”) from time to time. Unless we make a change for legal or administrative reasons, we will provide reasonable advance notice before the Updated Terms become effective. You agree that we may notify you of the Updated Terms by posting them on the Service, and that your use of the Service after the effective date of the Updated Terms (or engaging in such other conduct as we may reasonably specify) constitutes your agreement to the Updated Terms. Therefore, you should review these Terms of Service and any Updated Terms before using the Service. The Updated Terms will be effective as of the time of posting, or such later date as may be specified in the Updated Terms, and will apply to your use of the Service from that point forward. These Terms of Use will govern any disputes arising before the effective date of the Updated Terms.

- We reserve the right to refuse access to the Service to anyone for any reason at any time.

- We reserve the right to force forfeiture of any username for any reason.

- We may, but have no obligation to, remove, edit, block, and/or monitor Content or accounts containing Content that we determine in our sole discretion violates these Terms of Service.

- There may be links from the Service, or from communications you receive from the Service, to third-party web sites or features. There may also be links to third-party web sites or features in images or comments within the Service. The Service also includes third-party content that we do not control, maintain or endorse. Functionality on the Service may also permit interactions between the Service and a third-party web site or feature, including applications that connect the Service or your account on the Service with a third-party web site or feature.

- You agree that you are responsible for all data charges you incur through use of the Service.

- We prohibit crawling, scraping, caching or otherwise accessing any content on the Service via automated means (except as may be the result of standard search engine protocols or technologies used by a search engine with BluSignals’express consent).

Rights

- Some of the Service is supported by advertising revenue and may display advertisements and promotions, and you hereby agree that BluSignals may place such advertising and promotions on the Service. The manner, mode and extent of such advertising and promotions are subject to change without specific notice to you.

- You acknowledge that we may not always identify paid services, sponsored content, or commercial communications as such.

- The Service contains content owned or licensed by BluSignals (“BluSignals Content”). BluSignals Content is protected by copyright, trademark, patent, trade secret and other laws, and, as between you and BluSignals, BluSignals owns and retains all rights in the BluSignals Content and the Service. You will not remove, alter or conceal any copyright, trademark, service mark or other proprietary rights notices incorporated in or accompanying the BluSignals Content and you will not reproduce, modify, adapt, prepare derivative works based on, perform, display, publish, distribute, transmit, broadcast, sell, license or otherwise exploit the BluSignals Content.

- The BluSignals name and logo are trademarks of BluSignals, and may not be copied, imitated or used, in whole or in part, without the prior written permission of BluSignals. In addition, all page headers, custom graphics, button icons and scripts are service marks, trademarks and/or trade dress of BluSignals, and may not be copied, imitated or used, in whole or in part, without prior written permission from BluSignals.

- Although it is BluSignals’intention for the Service to be available as much as possible, there will be occasions when the Service may be interrupted, including, without limitation, for scheduled maintenance or upgrades, for emergency repairs, or due to failure of telecommunications links and/or equipment. Also, BluSignals reserves the right to remove any Content from the Service for any reason, without prior notice. Content removed from the Service may continue to be stored by BluSignals, including, without limitation, in order to comply with certain legal obligations, but may not be retrievable without a valid court order.

Disclaimer

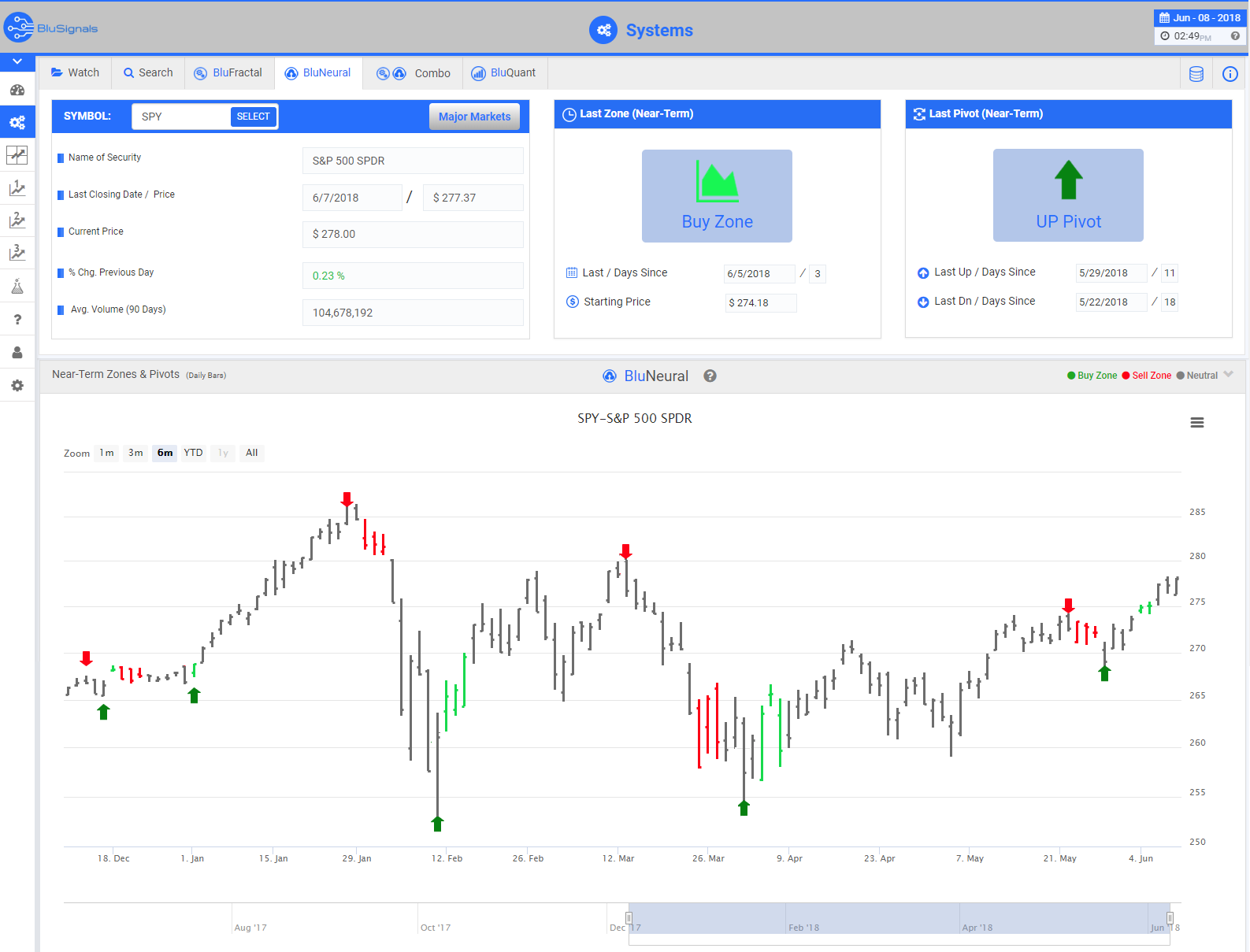

BluSignals is a service. We provide independent information on a subscription basis to our users. The “Signals” from our systems are only recommendations that our users are free to act upon and utilize as they best see fit. Our recommended method of use, as described on this website, DOES NOT represent personalized financial advice to the user. As such, our signal information merely serves as a guide and suggested approach, not final investment research; nor do we claim to provide a complete and full analysis of any stated security.

No statement or expression of opinion, nor any other matter herein, including our signals themselves, directly or indirectly, is an offer or the solicitation of any offer to buy or sell the securities mentioned within, nor any other securities. Persons investing in securities must independently verify and evaluate all information contained in this website and our signal data. Furthermore, the use of our signals for trading purposes may not be suitable to all investors.

Subscribing to our service, or utilizing our signals for investment, in no way constitutes a client / adviser relationship. All data and information we communicate to our users either through our website, emails, text messages or any other form of communication, is purely:

- FOR INFORMATION PURPOSES ONLY.

- NO ADVICE IS GIVEN OR IMPLIED.

- USERS ASSUME SOLE LIABILITY FOR THEIR INVESTMENT DECISIONS

- THERE IS NO GUARANTEE OF PERFORMANCE

Warranties

THE SERVICE, INCLUDING, WITHOUT LIMITATION, BLUSIGNALS CONTENT, IS PROVIDED ON AN “AS IS”, “AS AVAILABLE” AND “WITH ALL FAULTS” BASIS. TO THE FULLEST EXTENT PERMISSIBLE BY LAW, NEITHER BLUSIGNALS NOR ITS PARENT COMPANY NOR ANY OF THEIR EMPLOYEES, MANAGERS, OFFICERS OR AGENTS (COLLECTIVELY, THE “BLUSIGNALS PARTIES”) MAKE ANY REPRESENTATIONS OR WARRANTIES OR ENDORSEMENTS OF ANY KIND WHATSOEVER, EXPRESS OR IMPLIED, AS TO: (A) THE SERVICE; (B) THE BLUSIGNALS CONTENT; (C) USER CONTENT; OR (D) SECURITY ASSOCIATED WITH THE TRANSMISSION OF INFORMATION TO BLUSIGNALS `OR VIA THE SERVICE. IN ADDITION, THE BLUSIGNALS PARTIES HEREBY DISCLAIM ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, THE WARRANTIES OF MERCHANT ABILITY, FITNESS FOR A PARTICULAR PURPOSE, NON-INFRINGEMENT, TITLE, CUSTOM, TRADE, QUIET ENJOYMENT, SYSTEM INTEGRATION AND FREEDOM FROM COMPUTER VIRUS.

THE BLUSIGNALS PARTIES DO NOT REPRESENT OR WARRANT THAT THE SERVICE WILL BE ERROR-FREE OR UNINTERRUPTED; THAT DEFECTS WILL BE CORRECTED; OR THAT THE SERVICE OR THE SERVER THAT MAKES THE SERVICE AVAILABLE IS FREE FROM ANY HARMFUL COMPONENTS, INCLUDING, WITHOUT LIMITATION, VIRUSES. THE BLUSIGNALS PARTIES DO NOT MAKE ANY REPRESENTATIONS OR WARRANTIES THAT THE INFORMATION (INCLUDING ANY INSTRUCTIONS) ON THE SERVICE IS ACCURATE, COMPLETE, OR USEFUL. YOU ACKNOWLEDGE THAT YOUR USE OF THE SERVICE IS AT YOUR SOLE RISK. THE BLUSIGNALS PARTIES DO NOT WARRANT THAT YOUR USE OF THE SERVICE IS LAWFUL IN ANY PARTICULAR

JURISDICTION, AND THE BLUSIGNALS PARTIES SPECIFICALLY DISCLAIM SUCH WARRANTIES. SOME JURISDICTIONS LIMIT OR DO NOT ALLOW THE DISCLAIMER OF IMPLIED OR OTHER WARRANTIES SO THE ABOVE DISCLAIMER MAY NOT APPLY TO YOU TO THE EXTENT SUCH JURISDICTION’S LAW IS APPLICABLE TO YOU AND THESE TERMS OF SERVICE. BY ACCESSING OR USING THE SERVICE YOU REPRESENT AND WARRANT THAT YOUR ACTIVITIES ARE LAWFUL IN EVERY JURISDICTION WHERE YOU ACCESS OR USE THE SERVICE. THE BLUSIGNALS PARTIES DO NOT ENDORSE CONTENT AND SPECIFICALLY DISCLAIM ANY RESPONSIBILITY OR LIABILITY TO ANY PERSON OR ENTITY FOR ANY LOSS, DAMAGE (WHETHER ACTUAL, CONSEQUENTIAL, PUNITIVE OR OTHERWISE), INJURY, CLAIM, LIABILITY OR OTHER CAUSE OF ANY KIND OR CHARACTER BASED UPON OR RESULTING FROM ANY CONTENT.

Limitation of Liability; Waiver

UNDER NO CIRCUMSTANCES WILL THE BLUSIGNALS PARTIES BE LIABLE TO YOU FOR ANY LOSS OR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, FOR ANY DIRECT, INDIRECT, ECONOMIC,EXEMPLARY, SPECIAL, PUNITIVE, INCIDENTAL OR CONSEQUENTIAL LOSSES OR DAMAGES) THAT ARE DIRECTLY OR INDIRECTLY RELATED TO: (A) THE SERVICE; (B) THE BLUSIGNALS CONTENT; (C) USER CONTENT; (D) YOUR USE OF, INABILITY TO USE, OR THE PERFORMANCE OF THE SERVICE; (E) ANY ACTION TAKEN IN CONNECTION WITH AN INVESTIGATION BY THE BLUSIGNALS PARTIES OR LAW ENFORCEMENT AUTHORITIES REGARDING YOUR OR ANY OTHER PARTY’S USE OF THE SERVICE; (F) ANY ACTION TAKEN IN CONNECTION WITH COPYRIGHT OR OTHER INTELLECTUAL PROPERTY OWNERS; (G) ANY ERRORS OR OMISSIONS IN THE SERVICE’S OPERATION; OR (H) ANY DAMAGE TO ANY USER’S COMPUTER, MOBILE DEVICE, OR OTHER EQUIPMENT OR TECHNOLOGY INCLUDING, WITHOUT LIMITATION, DAMAGE FROM ANY SECURITY BREACH OR FROM ANY VIRUS, BUGS, TAMPERING, FRAUD, ERROR, OMISSION, INTERRUPTION, DEFECT, DELAY IN OPERATION OR TRANSMISSION, COMPUTER LINE OR NETWORK FAILURE OR ANY OTHER TECHNICAL OR OTHER MALFUNCTION, INCLUDING, WITHOUT LIMITATION, DAMAGES FOR LOST PROFITS, LOSS OF GOODWILL, LOSS OF DATA, WORK STOPPAGE, ACCURACY OF RESULTS, OR COMPUTER FAILURE OR MALFUNCTION, EVEN IF FORESEEABLE OR EVEN IF THE BLUSIGNALS PARTIES HAVE BEEN ADVISED OF OR SHOULD HAVE KNOWN OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN AN ACTION OF CONTRACT,NEGLIGENCE, STRICT LIABILITY OR TORT (INCLUDING, WITHOUT LIMITATION, WHETHER CAUSED IN WHOLE

OR IN PART BY NEGLIGENCE, ACTS OF GOD, TELECOMMUNICATIONS FAILURE, OR THEFT OR DESTRUCTION OF THE SERVICE). IN NO EVENT WILL THE BLUSIGNALS PARTIES BE LIABLE TO YOU OR ANYONE ELSE FOR LOSS, DAMAGE OR INJURY, INCLUDING, WITHOUT LIMITATION, DEATH OR PERSONAL INJURY. SOME STATES DO NOT ALLOW THE EXCLUSION OR LIMITATION OF INCIDENTAL OR CONSEQUENTIAL DAMAGES, SO THE ABOVE LIMITATION OR EXCLUSION MAY NOT APPLY TO YOU. IN NO EVENT WILL THE BLUSIGNALS PARTIES TOTAL LIABILITY TO YOU FOR ALL DAMAGES, LOSSES OR CAUSES OR ACTION EXCEED ONE HUNDRED UNITED STATES DOLLARS ($100.00).

YOU AGREE THAT IN THE EVENT YOU INCUR ANY DAMAGES, LOSSES OR INJURIES THAT ARISE OUT OF BLUSIGNALS’ ACTS OR OMISSIONS, THE DAMAGES, IF ANY, CAUSED TO YOU ARE NOT IRREPARABLE OR SUFFICIENT TO ENTITLE YOU TO AN INJUNCTION PREVENTING ANY EXPLOITATION OF ANY WEB SITE, SERVICE, PROPERTY, PRODUCT OR OTHER CONTENT OWNED OR CONTROLLED BY THE BLUSIGNALS PARTIES, AND YOU WILL HAVE NO RIGHTS TO ENJOIN OR RESTRAIN THE DEVELOPMENT, PRODUCTION, DISTRIBUTION, ADVERTISING, EXHIBITION OR EXPLOITATION OF ANY WEB SITE, PROPERTY, PRODUCT, SERVICE, OR OTHER CONTENT OWNED OR CONTROLLED BY THE BLUSIGNALS PARTIES.

BY ACCESSING THE SERVICE, YOU UNDERSTAND THAT YOU MAY BE WAIVING RIGHTS WITH RESPECT TO CLAIMS THAT ARE AT THIS TIME UNKNOWN OR UNSUSPECTED. BLUSIGNALS IS NOT RESPONSIBLE FOR THE ACTIONS, CONTENT, INFORMATION, OR DATA OF THIRDPARTIES, AND YOU RELEASE US, OUR DIRECTORS, OFFICERS, EMPLOYEES, AND AGENTS FROM ANY CLAIMS AND DAMAGES, KNOWN AND UNKNOWN, ARISING OUT OF OR IN ANY WAY CONNECTED WITH ANY CLAIM YOU HAVE AGAINST ANY SUCH THIRD PARTIES.

Indemnification

You (and also any third party for whom you operate an account or activity on the Service) agree to defend (at BluSignals’ request), indemnify and hold the BluSignals Parties harmless from and against any claims, liabilities, damages, losses, and expenses, including without limitation, reasonable attorney’s fees and costs, arising out of or in any way connected with any of the following (including as a result of your direct activities on the Service or those conducted on your behalf): (i) your access to or use of the Service; (ii) your breach or alleged breach of these Terms of Service; (iii) your violation of any third-party right, including without limitation, any intellectual property right, publicity, confidentiality, property or privacy right; (iv) your violation of any laws, rules, regulations, codes, statutes, ordinances or orders of any governmental and quasi-governmental authorities, including, without limitation, all regulatory, administrative and legislative authorities; or (v) any misrepresentation made by you. You will cooperate as fully required by BluSignals in the defense of any claim. BluSignals reserves the right to assume the exclusive defense and control of any matter subject to indemnification by you, and you will not in any event settle any claim without the prior written consent of BluSignals.

Arbitration

You agree that all disputes between you and BluSignals (whether or not such dispute involves a third party) with regard to your relationship with BluSignals, including without limitation disputes related to these Terms of Service, your use of the Service, and/or rights of privacy and/or publicity, will be resolved by binding, individual arbitration under the American Arbitration Association’s rules for arbitration of consumer-related disputes and you and BluSignals hereby expressly waive trial by jury. Furthermore, you may bring claims only on your own behalf. Neither you nor BluSignals will participate in a class action or class-wide arbitration for any claims covered by this agreement. You also agree not to participate in claims brought in a private attorney general or representative capacity, or consolidated claims involving another person’s account, if BluSignals is a party to the proceeding. This dispute resolution provision will be governed by the Federal Arbitration Act. In the event the American Arbitration Association is unwilling or unable to set a hearing date within one hundred and sixty (160) days of filing the case, then either BluSignals or you can elect to have the arbitration administered instead by the Judicial Arbitration and Mediation Services. Judgment on the award rendered by the arbitrator may be entered in any court having competent jurisdiction. Any provision of applicable law notwithstanding, the arbitrator will not have authority to award damages, remedies or awards that conflict with these Terms of Service. This arbitration agreement will survive the termination of your relationship with BluSignals.

Time Limitation on Claims

You agree that any claim you may have arising out of or related to your relationship with BluSignals must be filed within one year after such claim arose; otherwise, your claim is permanently barred.

Governing Law & Venue

These Terms of Service are governed by and construed in accordance with the laws of the State of New York, without giving effect to any principles of conflicts of law AND WILL SPECIFICALLY NOT BE GOVERNED BY THEUNITED NATIONS CONVENTIONS ON CONTRACTS FOR THE INTERNATIONAL SALE OF GOODS, IFOTHERWISE APPLICABLE. For any action at law or in equity relating to the arbitration provision of these Terms of Service, you agree to resolve any dispute you have with BluSignals exclusively in a state or federal court located in New York, New York, and to submit to the personal jurisdiction of the courts located in New York for the purpose of litigating all such disputes.

If any provision of these Terms of Service is held to be unlawful, void, or for any reason unenforceable during arbitration or by a court of competent jurisdiction, then that provision will be deemed severable from these Terms of Service and will not affect the validity and enforceability of any remaining provisions. BluSignals’failure to insist upon or enforce strict performance of any provision of these terms will not be construed as a waiver of any provision or right. No waiver of any of these Terms will be deemed a further or continuing waiver of such term or condition or any other term or condition. BluSignals reserves the right to change this dispute resolution provision, but any such changes will not apply to disputes arising before the effective date of the amendment. This dispute resolution provision will survive the termination of any or all of your transactions with BluSignals.

Entire Agreement

These Terms of Service constitute the entire agreement between you and BluSignals and governs your use of the Service, superseding any prior agreements between you and BluSignals. You will not assign the Terms of Service or assign any rights or delegate any obligations hereunder, in whole or in part, whether voluntarily or by operation of law, without the prior written consent of BluSignals. Any purported assignment or delegation by you without the appropriate prior written consent of BluSignals will be null and void. BluSignals may assign these Terms of Service or any rights hereunder without your consent. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid or otherwise unenforceable, the parties nevertheless agree that such portion will be deemed severable from these Terms of Service and will not affect the validity and enforceability of the remaining provisions, and the remaining provisions of the Terms of Service remain in full force and effect. Neither the course of conduct between the parties nor trade practice will act to modify the Terms of Service. These Terms of Service do not confer any third-party beneficiary rights.

Territorial Restrictions

The information provided within the Service is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject BluSignals to any registration requirement within such jurisdiction or country. We reserve the right to limit the availability of the Service or any portion of the Service, to any person, geographic area, or jurisdiction, at any time and in our sole discretion, and to limit the quantities of any content, program, product, service or other feature that BluSignals provides.

Software related to or made available by the Service may be subject to United States export controls. Thus, no software from the Service may be downloaded, exported or re-exported: (a) into (or to a national or resident of) any country to which the United States has embargoed goods; or (b) to anyone on the U.S. Treasury Department’s list of Specially Designated Nationals or the U.S. Commerce Department’s Table of Deny Orders. By downloading any software related to the Service, you represent and warrant that you are not located in, under the control of, or a national or resident of, any such country or on any such list.

The effective date of these Terms of Service is January 1, 2017. These Terms of Service were written in English (US). To the extent any translated version of these Terms of Service conflicts with the English version, the English version controls.

What this means is that for a digital computer to achieve an ordered result, it needs one over-arching program to direct it and tell each semiconductor just what to do to contribute toward the overall goal. A brain, on the other hand, unifies billions of tiny, exceedingly simple units that can each have their own programming and make decisions without the need for an outside authority.

What this means is that for a digital computer to achieve an ordered result, it needs one over-arching program to direct it and tell each semiconductor just what to do to contribute toward the overall goal. A brain, on the other hand, unifies billions of tiny, exceedingly simple units that can each have their own programming and make decisions without the need for an outside authority.